Quantity Or Quality?

Imagine placing an ad in a newspaper or online of your most ideal customer. What would it look like? Would their proximity be 30 miles from your retail location? Would they have spent over $1000 last year? Or perhaps they are majority women, ages 25-45. Every company has their “best customers.” The customers that are loyal to your brand or retail store, that spend the most and frequent your store often. It’s extremely important to know who these people are because they are what's keeping your business running! Roughly 80% of your revenue comes from only 20% of your customers. Thus, paying close attention to this unique set of customers is critical for your business to thrive. It takes quantity and quality to make a loyal customer.

Understanding RFM Score

The way we like to score our client’s database is with the RFM score, which stands for recency, frequency, monetary. At its core, RFM is a method for understanding customer value that has been used in marketing for over 20 years. Here’s how to define each:

- Recency - How recently did the customer purchase?

- Frequency - How often do the customer purchase?

- Monetary Value - How much does the customer spend?

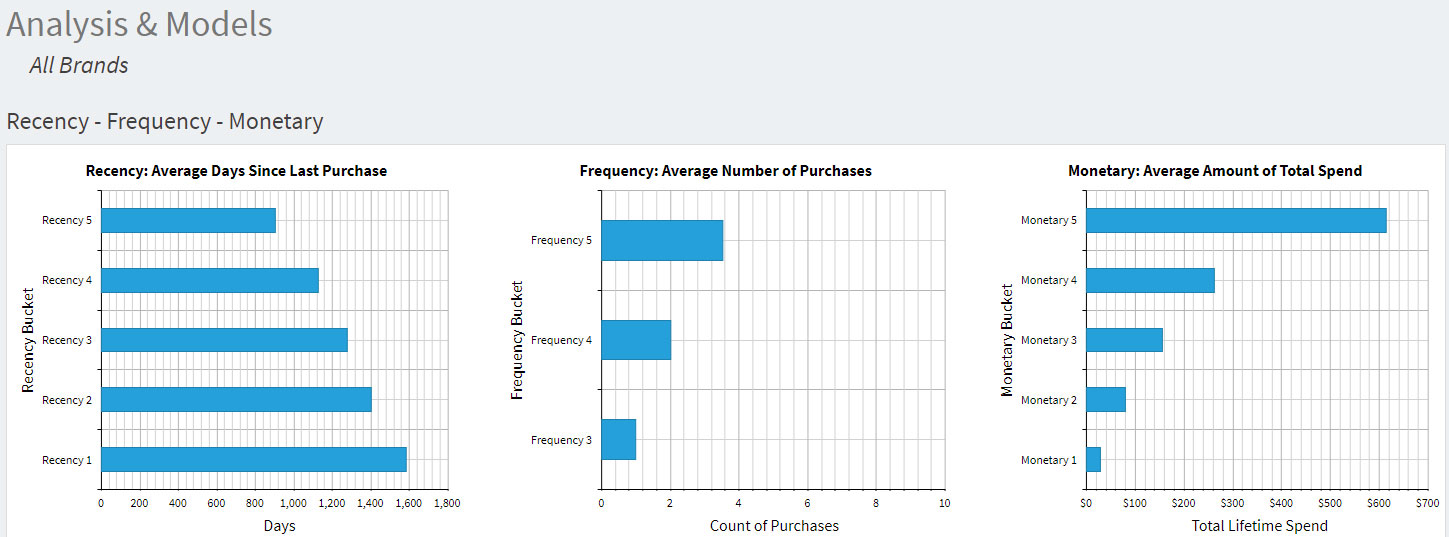

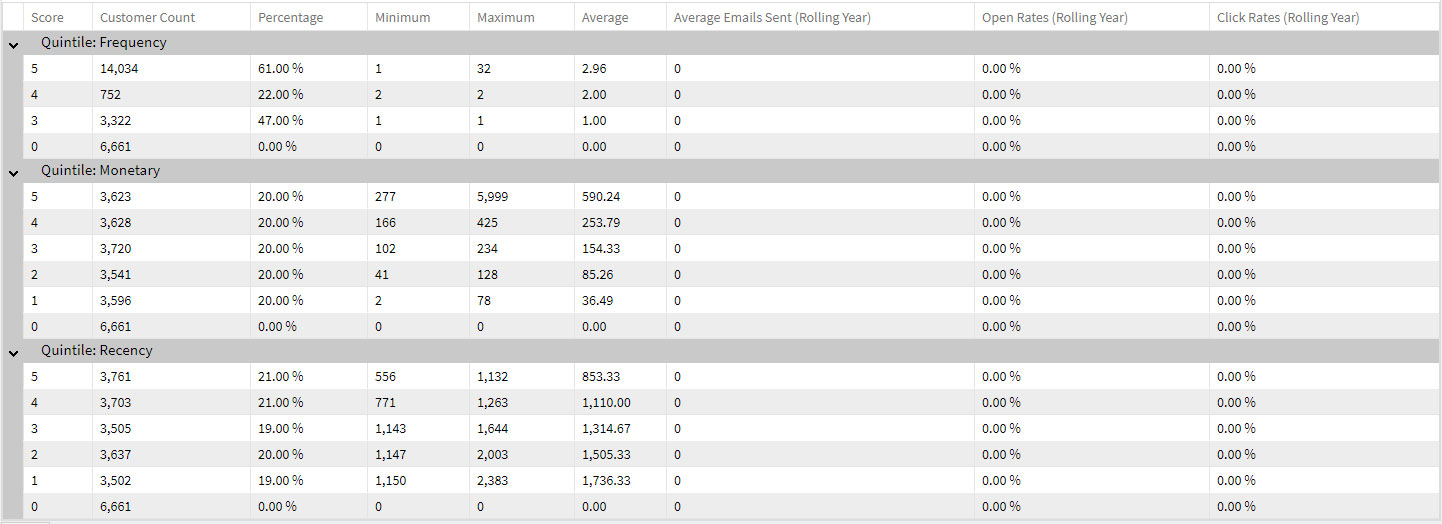

Recency:

The idea behind ‘Recency’ is that customers who have purchased from your business recently are much more likely to respond to a new offer than someone who had made a purchase in the distant past. Recency quintiles are based on the date of most recent purchase at your business and are organized by the minimum/maximum number of days since their last purchase. As a result, the more recent a record’s last transaction date is, the higher the quintile score will be assigned to that record. Thus, customers with the top 20% most recent transactions (in terms of Recency) are given a code of "5". The next 20% in terms of recent purchases is coded as "4", and so on until all records in your database are now assigned either a 5, 4, 3, 2, or 1 in terms of Recency.

Example of Recency quintile breakdown:

#5: 7 days – 60 days

#4: 60 days – 120 days

#3: 120 days – 240 days

#2: 240 days – 300 days

#1: 300 days – Oldest transaction date associated with a record in your database

Frequency:

Frequency quintiles are based on the sum quantity of total lifetime transactions each customer has made at your business. Customers are sorted in the database by this number – from the most to least frequent, coding the top 20% as "5", and the less frequent quintiles as 4, 3, 2, and 1. Something to note about Frequency though is that brand new customers will have a Recency code of "5", but a frequency code of "1", resulting in the lowest frequency quintile containing your newest customers.

Example of Frequency quintile breakdown:

#5: 5 transactions – Maximum number of transactions associated with a record in your database

#4: 4 transactions

#3: 3 transactions

#2: 2 transactions

#1: 1 transaction

#0: 0 transactions

Monetary:

Monetary quintiles are organized into quintiles based on the sum-total of lifetime dollar sales. The big spenders will be assigned a “5”, and the others, 4, 3, 2, and 1. Customers are organized by the minimum/maximum amount of total dollars spent with your business.

Example of Monetary quintile breakdown:

#5: $400.00 – Highest lifetime total dollar sales associated with a record in your database

#4: $200.00 - $400.00

#3: $100.00 - $200.00

#2: $50.00 - $100.00

#1: $1.00 - $50.00

#0: $0.00

Putting The Three Codes Together

RFM analysis always depends on Recency, Frequency, and Monetary measures, but the real power of the score comes from combining them into a three-digit RFM "cell code." Using the quintile system explained above, all customers end up with three digits in their database records. They are either 555, 554, 553, 552, 551, 545...down to 111.

Using Your RFM Score

Now that you understand what an RFM is, let’s talk through how to use it going forward. There are so many ways you can use these insights. Using your scores of 5 or 4, you can not only market to those customers differently, but you can also find prospects just like them! For example, you could upload a list of those customers to Facebook using Lookalike Audiences, and it will create a new prospect audience based on that list. From there, you can show your new prospects ads that will hopefully attract them to your page!